WE HAVE ONE GOAL

To get you the most metal for the best price.

CURRENT METAL PRICES

Gold: $2,647.30 USD

Silver: $30.56 USD

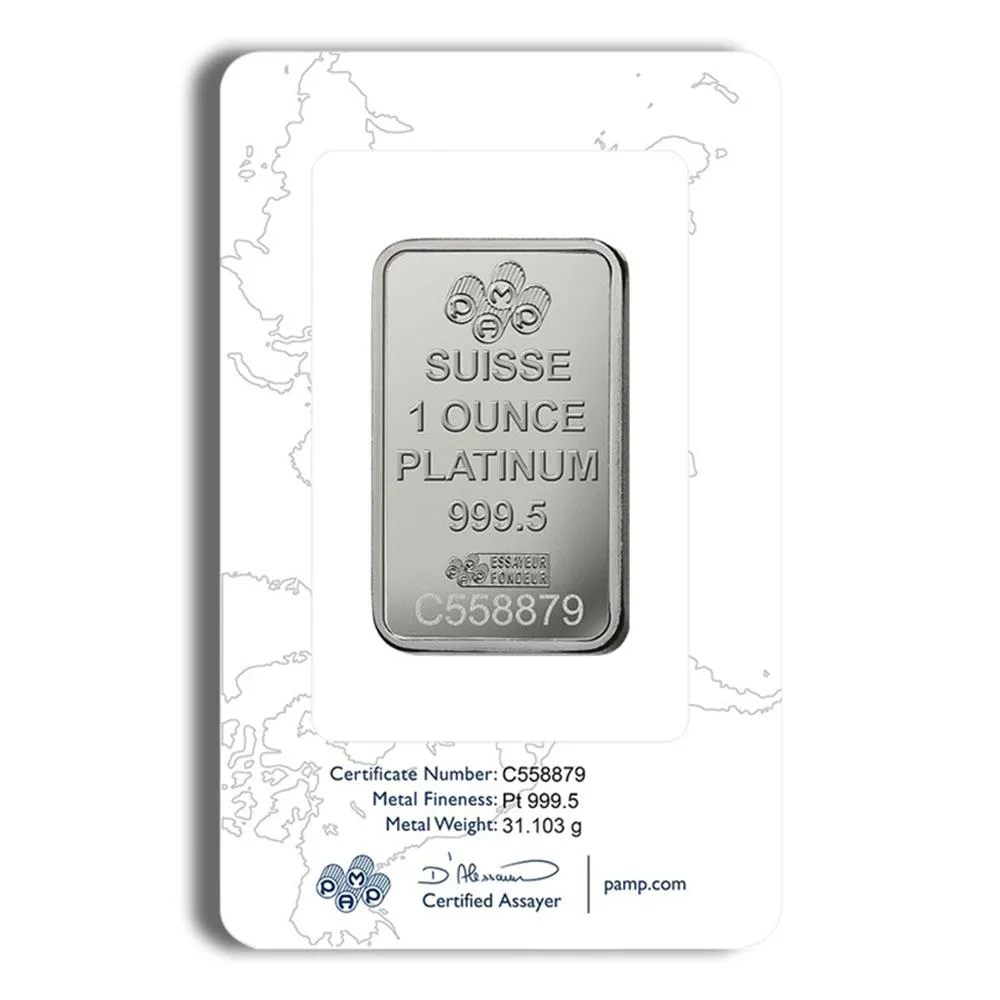

Platinum: $947.95 USD

Palladium: $978.90 USD

Featured Items

Current Metal Pricing

THE CALLAHAN ASSETS DIFFERENCE

We believe you should be able to buy metals in the same way larger institutions and family offices do, and that is through bullion and volume. With the popularity of gold and silver on the rise, many companies you hear advertising over the air waves are pushing products that are designed to hide exorbitant fees. Callahan Assets will always only sell bullion in standard sizes. Investors should be afforded the right to protect their portfolio without having to worry about being taken advantage of by the companies servicing them.

Ethically, there should be a business built for the client, focusing on getting them the most metal for the best price.

At Callahan Assets, we understand that you have many options when it comes to investing inside your IRA or 401(k). That's why we treat each investor with the same level of dedication and respect. Our approach is education-first: we empower you with the knowledge you need before making the important decision regarding which metals to purchase.

Whether you are new to purchasing metal and are looking to safeguard your earnings against current market instability, or you are entering your legacy years and want to rest assured that your assets are secured, we’re here to help you get the most metals for the best price.

Our Process

Establish Account

Fill out basic information HERE or call us at (310) 421-8093 and we’ll guide you every step of the way. Establishing an account takes no financial commitment. The next step is the Rollover.

Rollover

You are in control of your funds at all times. We partner with independent custodians Horizon Trust and Kingdom Trust, to convert the portion of your portfolio you choose into precious metals. This process is designed to be simple, tax-free, and penalty-free, and our team can even handle most of the paperwork for you.

Funded Account - Metals Allocation

Once the trust rolls over your IRA, your funds will be available to secure your precious metals. If you know what metals you want, perfect! We’re dedicated to getting you the best price. If not, our team will guide you through the available metals and the best prices to help you determine what fits your needs best. Once you've finalized your choices, we will secure your order and lock in your metals.

Vault Delivery - Depository VerificatioN

The depository and your custodian will go through a meticulous process to weigh and authenticate your physical metals before they are secured for storage in your designated vault.

OUR PROCESS

Establish Account

Fill out basic information HERE or call us at (310) 421-8093 and we’ll guide you every step of the way. Establishing an account takes no financial commitment. The next step is the Rollover.

Rollover

You are in control of your funds at all times. We partner with independent custodians Horizon Trust and Kingdom Trust, to convert the portion of your portfolio you choose into precious metals. This process is designed to be simple, tax-free, and penalty-free, and our team can even handle most of the paperwork for you.

Funded Account - Metals Allocation

Once the trust rolls over your IRA, your funds will be available to secure your precious metals. If you know what metals you want, perfect! We’re dedicated to getting you the best price. If not, our team will guide you through the available metals and the best prices to help you determine what fits your needs best. Once you've finalized your choices, we will secure your order and lock in your metals.

Vault Delivery - Depository VerificatioN

The depository and your custodian will go through a meticulous process to weigh and authenticate your physical metals before they are secured for storage in your designated vault.

WHY I STARTED CALLAHAN ASSETS

Gold, silver, and platinum are some of the oldest commodities on earth and have been used as a store of value for thousands of years. In fact, today's major investment houses still look to Bullion to hedge their portfolios; but even with such longevity and history, the markets for precious metals today can be confusing for retail investors.

Far too often we see people fall victim to schemes where sellers push "Premium Bullion", proof, or numismatic coins, often claiming they are rare or highly collectible. These products can sometimes carry markups of 35% or even 45%, leaving buyers in the dark about their true value until the moment they attempt to sell. This lack of transparency can turn what you thought was a sound investment into a frustrating and costly experience.

At Callahan Assets, we believe investing in precious metals should be simple, transparent and straightforward. That Main Street should be able to buy metals the same as Wall Street; through Bullion and only Bullion. That’s why we built our company around a single principle: providing our clients with the most metal for the best price.

We focus exclusively on Bullion, steering clear of high-premium and high-markup products. By keeping our overhead as low as possible, we ensure that more of your money goes toward real, tangible value—precious metals you can count on.

ABOUT

Our Mission

We specialize in helping you invest in physical precious metals, and our team can guide you every step of the way. By partnering with us, you can rest easy knowing you have a proven industry expert on your side who can show you how precious metal investments can protect your lifestyle and retirement, even in uncertain economic times.

What You Need To Know About Investing In Precious Metals

Many precious metals companies may try to confuse their clients by presenting portfolio examples that include a variety of different weights and ounces of random coins. This tactic is often used to make their clients believe that a diversified portfolio is the key to success while also making it difficult to ascertain the weight and actual value of the portfolio. It is designed to mislead and confuse those who are not familiar with the intricacies of investing in precious metals.

Many companies may also try to push certain coins that they have a vested interest in selling, even if those coins may not be the best fit for the investor's needs. It is crucial for investors to be vigilant and do their due diligence before entrusting their hard-earned money to anyone.

If you’re actively looking to purchase metal and a salesman has suggested proof or numismatic coins, do your retirement savings a huge favor and call around to see who is willing to liquidate those coins and at what price.

Afterward, contact us for a no-commitment quote on traditional bullion today. Whether you buy from us or not, you should feel comfortable that you are getting the best metal for you money.

Latest Articles

Gold Hits Record High—Is Silver the Next Big Opportunity?

Gold has just reached an all-time high, but the real question is: What’s next for silver? At Callahan Assets, we’ve been tracking this closely, and historically, silver often follows gold’s rise—somet... ...more

Benefits of Precious Metals

October 18, 2024•2 min read

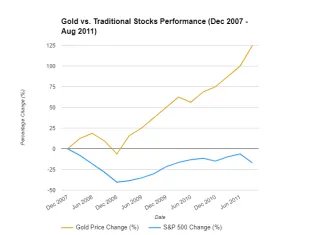

The Math Behind Hedging With Gold

In this blog, we'll explore how hedging just 20% of your IRA with gold from December 2007 to August 2011 could have protected and even grown your wealth, compared to those who kept their entire portfo... ...more

Benefits of Precious Metals ,Precious Metals in your Portfolio

September 13, 2024•3 min read

The Hidden Pitfalls of Premium Bullion: What You Need to Know

Proof and numismatic coins, while often presented as valuable collectibles, can carry hidden pitfalls that may surprise investors. ...more

Scams

September 13, 2024•4 min read

CFTC Warnings Expose Deceptive Practices in the Gold and Silver IRA Industry

In recent times, many individuals have considered diversifying their investment portfolios by adding precious metals like gold and silver to their Individual Retirement Accounts (IRAs)... ...more

CFTC Warnings

September 21, 2023•3 min read

Top 6 Scams to Avoid

TOP 6 Scams are all the same scam...to charge you more! The problem is that 9 out of the top 10 companies that I know of post similar articles, yet... ...more

Top 6 Scams to Avoid

May 22, 2023•4 min read

Currency Crisis

This article explains why adding gold to a retirement portfolio can be a smart way to protect savings from economic uncertainties and currency crises. The major points of the article... ...more

Currency

April 10, 2023•2 min read

Buyer Beware

No matter who you trust to invest your gold, silver, or other precious metals, be aware of the practices that are prevelant in the market.

Frequently Asked Questions

What is a Gold/Silver IRA?

A precious metals IRA works just like your existing retirement account except instead of owning shares of stocks and/or bonds, you will own physical metal that is allocated to your specific account.

Am I eligible to put physical gold and/or silver in my IRA?

Possibly. If you have an IRA or an old 401k from a previous employer, you should be able to do a tax-free, penalty-free rollover. Additionally, if you are over 59 1/2, you may rollover without penalty.

What types of metals can I purchase for my IRA?

This is one of the most important questions we get.

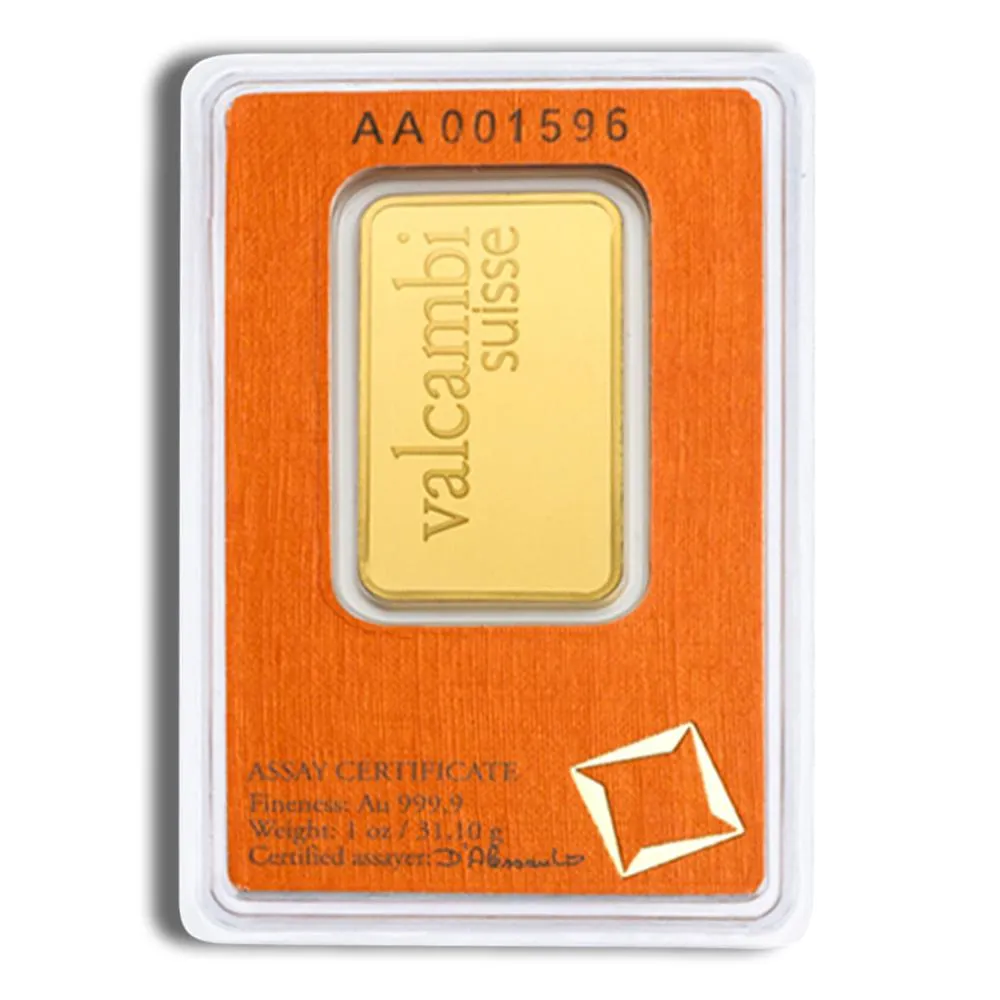

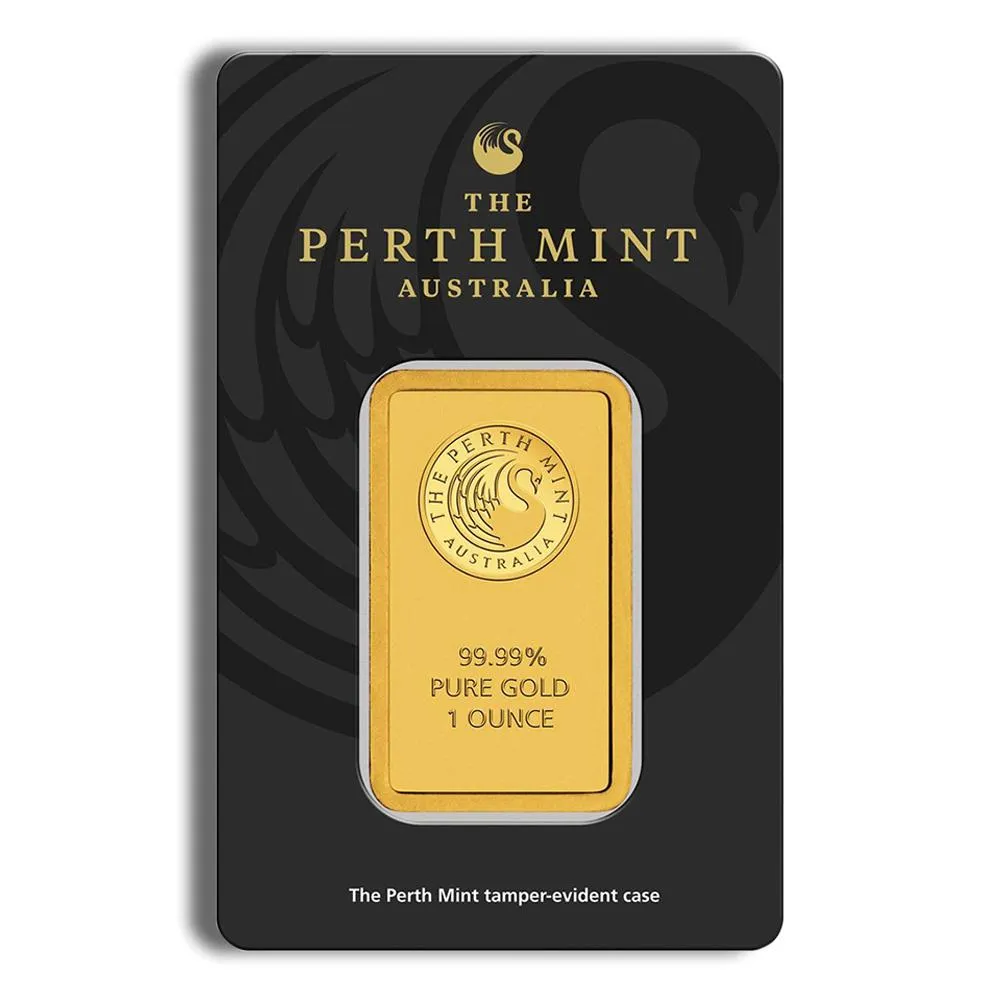

At Callahan Assets, we specialize in providing our clients with a carefully curated selection of precious metal investment options that focus on bullion bars and or coins (gold and silver). This is because there is a lot of misinformation about proof and numismatic coins, which sadly exposes many customers at other companies to bait and switch tactics.

We traditionally only sell the following:

GOLD

• 1 oz gold bar

• 1/4 oz gold US American Eagle

• 1/2 oz gold US American Eagle

• 1 oz gold US American Eagle

• 10 oz Gold bar

• 1 kilo Gold bar

SILVER

• 1 oz silver bar

• 1 oz silver round

• 1 oz silver US American Eagle

• 10 oz silver bar

Why Doesn't Callahan Assets Sell Proof or Numismatic Coins?

When it comes to investing in precious metals, making informed decisions is crucial. One common question we get at Callahan Assets is why we don't sell proof or numismatic coins. The answer lies in our commitment to transparency, value, and providing the best investment options for our clients.

The Hidden Pitfalls of Proof and Numismatic Coins

Did you know any company can mint their own coin from the Royal Canadian Mint and set any price they'd like for it on the open market, regardless of how much value the weight of the metal actually has or how cheap it was for them to manufacture it? This fact alone should make any investor pause and reconsider where they are putting their money.

Proof and numismatic coins often carry significant premiums over their intrinsic metal value. These premiums are based on factors like rarity, design, and historical significance, which can be highly subjective and fluctuate over time. While these coins can be beautiful and hold collector's value, they are not always the best option for those looking to maximize their investment in precious metals.

The Real Value of Bullion

At Callahan Assets, we focus exclusively on selling bullion. Bullion refers to gold, silver, platinum, or palladium in the form of bars, ingots, or standardized coins. The value of bullion is primarily based on the metal content and current market price, making it a straightforward and reliable investment.

Our goal is simple: to get you the most metal for the best price. By selling bullion, we ensure that our clients' investments are directly tied to the market value of the precious metals, without the added complications and uncertainties associated with proof or numismatic coins.

Why Transparency Matters

In the world of precious metals investing, transparency is key. When you purchase bullion from Callahan Assets, you know exactly what you're getting. The price you pay reflects the current market value of the metal, plus a small premium to cover production and distribution costs. There are no hidden fees, speculative markups, or inflated prices based on arbitrary factors.

This transparency allows our clients to make informed decisions and feel confident in their investments. We believe that an honest, straightforward approach is the best way to build trust and long-term relationships with our clients.

Avoiding Common Pitfalls

Investing in proof or numismatic coins can be tempting, especially with the allure of owning a piece of history or a beautifully crafted item. However, these investments often come with risks that many investors are not aware of:

• High Premiums: The premiums on proof and numismatic coins can be exorbitant, significantly reducing the amount of metal you actually own for the same amount of money.

• Market Volatility: The value of these coins can be highly volatile, influenced by trends and collector demand, which may not always align with the broader precious metals market.

• Liquidity Issues: Selling proof or numismatic coins can be more challenging, as their value is often subjective and finding a buyer willing to pay the premium can be difficult.

The Callahan Assets Difference

By choosing Callahan Assets, you are opting for an investment strategy focused on maximizing your precious metals holdings. We believe that by providing high-quality bullion at competitive prices, we can help you build a robust and reliable investment portfolio.

Our commitment to offering only bullion means you can avoid the pitfalls associated with proof and numismatic coins. You get more metal for your money, greater market transparency, and a straightforward investment approach that aligns with your financial goals.

Conclusion

In conclusion, Callahan Assets does not sell proof or numismatic coins because our mission is to offer our clients the most value for their investments. By focusing on bullion, we provide a transparent, reliable, and cost-effective way to invest in precious metals. We encourage all investors to carefully consider their options and choose the path that offers the best return on investment. With Callahan Assets, you can trust that you're getting the most metal for the best price, every time.

What depository do you use?

We use Delaware Depository as we secure our metals from the east coast and it assists us with keeping costs down, expediting delivery, as well as it being one of the most trusted depositories in the country. There are other options, however, costs and shipping times may be subject to change.

Is my gold safe from any problems with the depository (flood, fraud, etc.)?

Delaware Depository Security and Reliability

Alongside physical security, cybersecurity is a top priority as Delaware Depository maintains appropriate internal controls over the confidentiality, integrity, and availability of systems and digital assets, as confirmed by SOC-1 audits conducted by a PCAOB-registered independent auditing firm.

As a strong indicator of the level of trust placed in Delaware Depository, Lloyds of London underwriters provide $1 billion in all-risk insurance coverage to protect customers against loss of or damage to precious metals in the custody of Delaware Depository.

“At Delaware Depository, customer assets are fully allocated, independently audited, and held completely off our own balance sheet. Our core values of security, integrity, and transparency have endured since we first formed Delaware Depository to be a trusted custodian of customer assets,” stated Jonathan Potts, the Managing Director of Delaware Depository.

Delaware Depository has earned the trust of its customers who primarily consist of banks, trust companies, and entities involved in the precious metals supply chain.

About Delaware Depository

Founded in 1999, Delaware Depository is a limited-purpose trust company that provides allocated and segregated precious metals safekeeping and fulfillment services for entities and individuals that need to store gold, silver, platinum and palladium bullion safely and securely. Delaware Depository’s fortified facilities are situated in Delaware and Nevada, offering customers the ability to geographically diversify storage of bullion in locations that are distant from areas where natural disasters and terrorist acts have occurred in the recent past. To learn more, visit www.delawaredepository.com.

Can I get metals shipped directly to me?

(link to home delivery page below)

What custodian do you use?

We work with Horizon Trust as they have the best customer service in the entire industry. Read more about them here.

Can I visit my metals

Visiting Your Precious Metals at the Delaware Depository

Once you purchase physical precious metals for your gold IRA through Callahan Assets, your coins, bars, and rounds are shipped to the Delaware Depository. Did you know that this depository allows owners to visit their precious metals in person? If you’ve ever wanted to see your precious metal IRA assets up close, here’s how you can do it.

Arranging Your Visit to the Delaware Depository

1. Contact Your Custodian:

• Start by reaching out to your custodian and requesting an in-person visit to the Delaware Depository.

2. Coordination:

• Your custodian will contact the depository on your behalf to initiate the visit.

3. Appointment Scheduling:

• The depository staff will then reach out to you directly to arrange a convenient appointment date and time. They will request identification documents (such as a driver’s license or passport) to confirm your identity before and during the visit. They will also confirm the details of your appointment.

4. Travel Arrangements:

• Plan your trip to the Delaware Depository in Wilmington, DE. You can make a special trip or incorporate it into a vacation, depending on your schedule.

What to Expect During Your Visit

First Impressions:

• The Delaware Depository is located in Wilmington, DE, is on a fairly busy road. From the outside, it looks like a typical office building – nothing flashy or out of the ordinary.

Security Procedures:

• Upon arrival, you will be met at the door by a member of the depository staff. Your identity and ownership will be confirmed through your identification documents. Expect to go through metal detectors, be on camera, and pass through several locked doors.

Viewing Your Precious Metals:

• You will be led to an empty conference room while another staff member retrieves your precious metals. Depositories typically use simple containers like plastic bins and cardboard boxes to keep your property organized.

Verification Process:

• Once your precious metals are brought into the room, you can verify that everything is present. You are allowed to perform your own audit, take pictures, and confirm your holdings, with a few exceptions:

• Do not photograph the depository’s employees or facilities.

• Do not attempt to remove anything from the premises.

Conclusion of the Visit:

• After you’re satisfied that everything is as it should be, or once your appointment duration ends, the depository employees will pack up your precious metals and return them to the vault. You will be courteously escorted to the exit.

Why Choose Callahan Assets?

At Callahan Assets, we are committed to transparency and security for your gold and silver IRAs. By offering storage at the Delaware Depository, we ensure that your precious metals are safeguarded in a reputable facility. The ability to visit your holdings in person provides additional peace of mind and assurance that your investments are secure.

Invest with confidence through Callahan Assets, knowing that your precious metals are not only protected but also accessible for your personal inspection.

Are my Metal safe?

Delaware Depository Security and Reliability

Alongside physical security, cybersecurity is a top priority as Delaware Depository maintains appropriate internal controls over the confidentiality, integrity, and availability of systems and digital assets, as confirmed by SOC-1 audits conducted by a PCAOB-registered independent auditing firm.

As a strong indicator of the level of trust placed in Delaware Depository, Lloyds of London underwriters provide $1 billion in all-risk insurance coverage to protect customers against loss of or damage to precious metals in the custody of Delaware Depository.

“At Delaware Depository, customer assets are fully allocated, independently audited, and held completely off our own balance sheet. Our core values of security, integrity, and transparency have endured since we first formed Delaware Depository to be a trusted custodian of customer assets,” stated Jonathan Potts, the Managing Director of Delaware Depository.

Delaware Depository has earned the trust of its customers who primarily consist of banks, trust companies, and entities involved in the precious metals supply chain.

About Delaware Depository

Founded in 1999, Delaware Depository is a limited-purpose trust company that provides allocated and segregated precious metals safekeeping and fulfillment services for entities and individuals that need to store gold, silver, platinum and palladium bullion safely and securely. Delaware Depository’s fortified facilities are situated in Delaware and Nevada, offering customers the ability to geographically diversify storage of bullion in locations that are distant from areas where natural disasters and terrorist acts have occurred in the recent past. To learn more, visit www.delawaredepository.com.

"THE LINE will tackle the challenges facing humanity in urban life today and will shine a light on alternative ways to live. We cannot ignore the livability and environmental crises facing our world’s cities, and NEOM is at the forefront of delivering new and imaginative solutions to address these issues. NEOM is leading a team of the brightest minds in architecture, engineering and construction to make the idea of building upwards a reality."

His Royal Highness

Mohammed bin Salman, Crown Prince and Chairman of the NEOM Company Board of Directors

WE WOULD LOVE TO CONNECT

WE WOULD LOVE TO CONNECT

By completing this form you are agreeing to being contacted by Callahan Assets. We will treat your information carefully. See our terms & conditions and privacy policy

2024 Callahan Assets