The Math Behind Hedging With Gold

`How Hedging 20% of Your IRA Portfolio with Gold Bullion Could Have Protected Your Retirement from 2007 to 2011

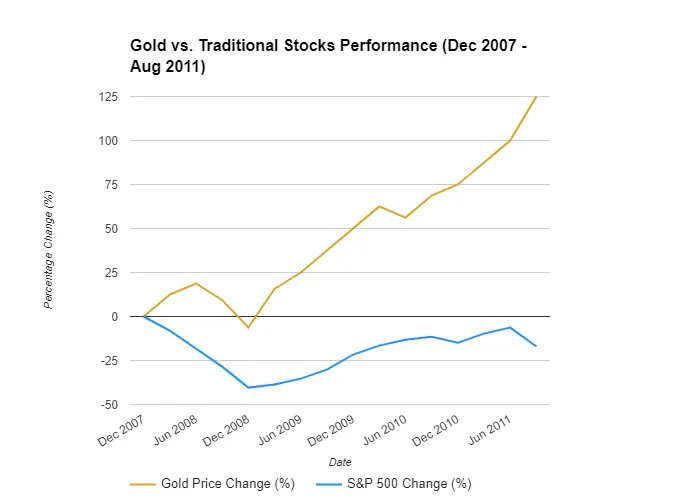

The financial crisis of 2008-2009 was a wake-up call for many investors, highlighting the vulnerabilities of traditional IRA portfolios reliant solely on stocks. However, those who diversified their retirement savings by allocating even a small portion to gold bullion fared much better. In this blog, we'll explore how hedging just 20% of your IRA with gold from December 2007 to August 2011 could have protected and even grown your wealth, compared to those who kept their entire portfolios in traditional stocks.

The Financial Crisis: December 2007 to August 2011

The period between December 2007 and August 2011 was marked by significant market volatility. The S&P 500, representing 500 of the largest publicly traded companies in the U.S., experienced a dramatic downturn followed by a slow recovery. Here are the key numbers:

S&P 500 in December 2007: Approximately 1,468 points

S&P 500 in August 2011: Approximately 1,218 points

This represents a net decline of around 17% over the period.

In contrast, gold prices surged during this time:

Gold Price in December 2007: Approximately $800 per ounce

Gold Price in August 2011: Approximately $1,800 per ounce

This equates to a substantial increase of 125%.

The Impact of a 20% Hedge with Gold

Let’s break down how hedging 20% of your IRA with gold bullion could have affected your portfolio during this volatile period.

Imagine you had a $100,000 IRA portfolio in December 2007, with 80% ($80,000) invested in the S&P 500 and 20% ($20,000) in gold. By August 2011, the value of the stock portion of your portfolio would have decreased by approximately 17%, reducing it to about $66,400.

However, the value of your gold holdings would have increased dramatically. With the price of gold rising by 125%, your $20,000 investment in gold would have grown to $45,000.

Portfolio Value with and without the Hedge

Without Gold Hedge:

Initial Portfolio Value (December 2007): $100,000

S&P 500 Decline (-17%): $83,000

Final Portfolio Value (August 2011): $83,000

With 20% Gold Hedge:

Initial Portfolio Value (December 2007): $100,000

Stock Portion (80%): $80,000 → $66,400 (after 17% decline)

Gold Portion (20%): $20,000 → $45,000 (after 125% gain)

Final Portfolio Value (August 2011): $66,400 (stocks) + $45,000 (gold) = $111,400

In this scenario, by allocating 20% of your IRA to gold, you would have not only avoided significant losses but also achieved a portfolio value of $111,400—an 11.4% increase over four years, compared to a 17% loss for a fully stock-based portfolio.

Why Gold Bullion Is an Essential Hedge

Gold has long been recognized as a hedge against economic uncertainty and inflation. Unlike stocks, which can be highly volatile during market downturns, gold tends to appreciate as investors seek safety. Including gold in your portfolio can provide a crucial buffer against market volatility, helping to protect and even grow your retirement savings during turbulent times.

Secure Your Retirement with a Strategic Gold Hedge

The period from 2007 to 2011 demonstrated the risks of relying solely on traditional stock investments for retirement. By hedging just 20% of your IRA with gold bullion, you could have significantly reduced your losses and preserved your wealth during one of the most challenging economic periods in recent history.

At Callahan Assets, we’re committed to helping you protect your financial future by offering the most metal for the best price. Whether you’re new to investing in gold or looking to diversify your portfolio further, our team is here to assist you every step of the way. Don’t wait for the next crisis—start securing your retirement with gold today.

If you have any questions, or would like more information on how to secure your retirement with gold, Click Here to schedule a call.